Infineon signs agreement to acquire Marvell Technology’s Automotive Ethernet business for 2.5 billion USD

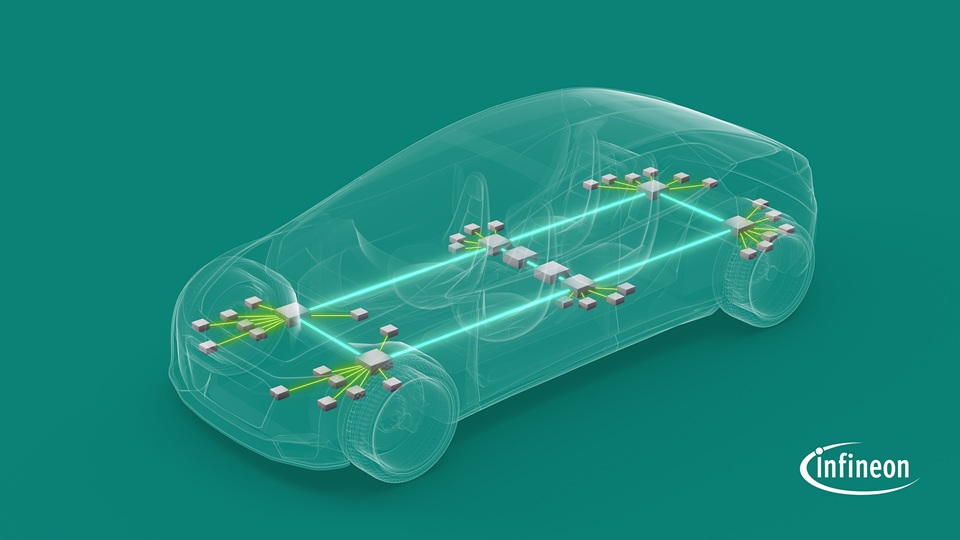

Infineon Technologies is accelerating the build-up of its system capabilities for software-defined vehicles with the acquisition of Marvell Technology’s Automotive Ethernet business, complementing and expanding its own market-leading microcontroller business.

Infineon and Marvell Technology have entered into a definitive transaction agreement for a purchase price of 2.5 billion USD in cash. The transaction is subject to regulatory approvals.

Ethernet is a key enabling technology for low-latency, high-bandwidth communication, which is crucial for software-defined vehicles. Additionally, it has significant potential in adjacent fields of use such as humanoid robots. The planned investment will strengthen Infineon’s already strong footprint in the U.S., including extensive R&D activities.

“The acquisition is a great strategic fit for Infineon as the global number one provider of semiconductor solutions to the automotive industry,” says Jochen Hanebeck, CEO of Infineon. “We will leverage this highly complementary Ethernet technology by combining it with our existing, broad product portfolio to provide our customers with even more comprehensive, leading solutions for software-defined vehicles. The transaction will support our profitable growth strategy going forward, including new opportunities in the field of physical AI such as humanoid robots.”

Among the customers of Marvell’s Automotive Ethernet business are more than 50 automotive manufacturers, including eight of the ten leading OEMs. The strong customer relationships are backed by a design-win pipeline of around US$4 billion until 2030 and a strong innovation roadmap, paving the way for future revenue growth.

The business is expected to generate revenue of US$225 – US$250 million in the 2025 calendar year with a gross margin of around 60%, based on the strong potential for further acceleration through Infineon’s access to global automotive customers. Additional cost synergies are expected from combining R&D forces and leveraging Infineon production reach.

After the transaction closes, Marvell’s Automotive Ethernet business will become part of Infineon’s Automotive division.

The transaction is subject to customary closing conditions, including regulatory approvals, and is expected to close within calendar year 2025.